- #Free financial software budget and debt elimination how to#

- #Free financial software budget and debt elimination free#

Debt Payoff Planner takes that in to consideration. A huge difference between the excel version of snowball debt to this is the fact that we have several loans that are zero percent interest for X amount of month. Extra bonus I really like is being able to make educated decisions on what to pay off and how much interest I will end up paying. I can customize what I want as a priority to pay off and see what my outcome will be, all with a slide of my finger.

That is were the Debt Payoff Planner excels. Once you input it it has to stay in that column. While that version is useful it is extremely hard to maintain and adjust my priorities. I am not a newbie to the debt snowball, I have a copy on my excel spreadsheet. This additional capability allows you to have tighter control over every dollar you are budgeting. A Debt Snowflake is a one-time payment from things like a bonus at work, a tax refund, an extra payday, etc. We allow the ability to provide a Debt Snowflake payoff as well. This customization is available for users that want to be their own debt manager. In addition to the Debt Snowball calculator and the Debt Avalanche method, many users like to do a custom sorting of their debts. * Other category could be anything from a paycheck loan to a hard money loan * Personal Loans to friends and family or other individuals * Mortgages like Rocket Mortgage, SoFi, etc. * Student Loans like Navient, Sallie Mae, Great Lakes, etc. * Credit Cards like Capital One, Citicard, Chase, etc. Also, there is some tips on credit card balance transfers as well as strategies for debt consolidation.

#Free financial software budget and debt elimination how to#

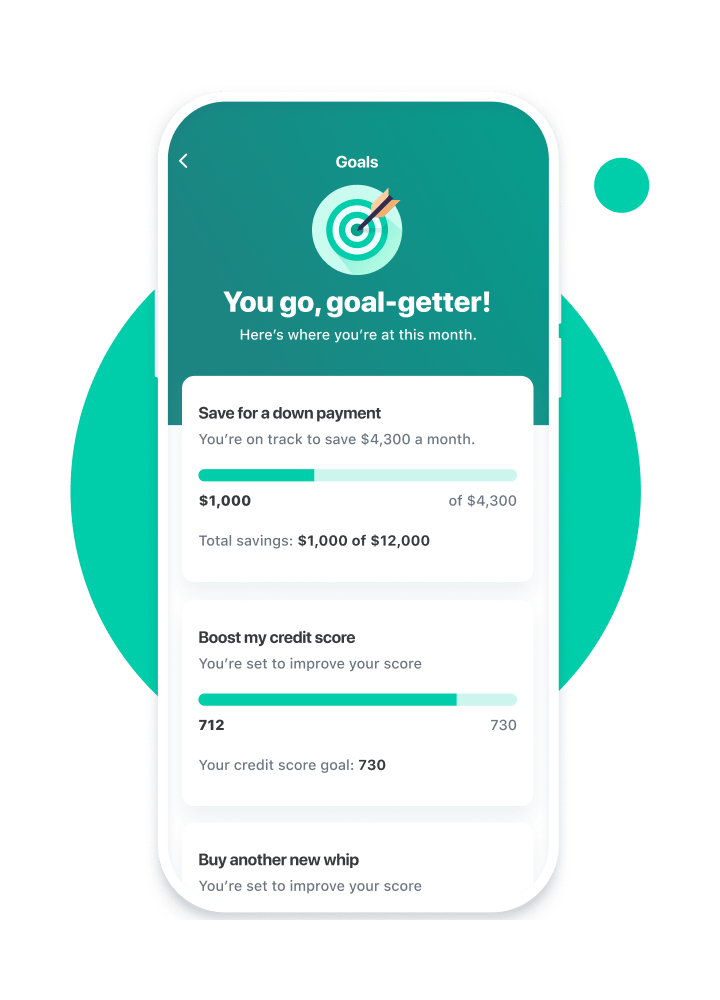

In addition to being a debt tracker and loan calculator, we are also trying to help point out some possible next steps with articles focused on how to pay off student loans, auto loans, and credit cards faster. The goal of payment tracking is to see your progress over time and affirm that you are staying focused on your financial goals. Inputting payment information is as simple as typing in the amount and the date the payment was made. The Debt Payoff Planner and Calculator is also used for tracking payments and updating the time-frame for becoming debt-free. The loan calculator has minimal inputs in order to make your money management easy to follow.

#Free financial software budget and debt elimination free#

We believe that becoming debt free requires an easy starting point and making sure every dollar is leveraged perfectly. Getting out of debt is hard, so we try to allow you to take baby steps toward this goal. Creating an account is entirely optional, but it does enable you to have a secure backup and your information is immediately available if you start using a new device. This account can be accessed across multiple devices, from multiple app stores. The payoff chart will show two payoff scenarios: only paying the minimum amounts, and the repayment schedule when you pay more the the minimum ever month.Īdditionally, there is an option to create an account for saving debt payoff and payment information. Budgeting your income will help you to get a regular monthly amount to pay down the debt faster.

:max_bytes(150000):strip_icc()/DebtPayoffAssistant-5b3a3bce46e0fb005b74b6ea.jpg)

Your ability and willingness to pay more than the minimum payments is how you will become debt free in less time than you imagined. A payoff plan is only useful if you stick with it! We recommend the Debt Snowball strategy because we believe that paying off individual accounts faster will help you stay focused on your financial goal of debt elimination. You tell the app how much you want to budget toward paying off your debt and we'll tell you how. * Debt Snowflake (one-time extra payment toward loans)ĭebt Payoff Planner and Loan Calculator determines the optimum payment plan and how long it will take until you will be debt free. * Dave Ramsey's Debt Snowball (lowest balance first) Enter your additional monthly payment budget to pay down faster That's the only requirement to getting a customized debt repayment schedule. Required inputs for calculating your debt free date are the current balance of the loan, the annual percentage rate (APR), and the minimum payment amount. Today is the day to make a plan with a loan calculator and beginning paying down debt. The Debt Payoff Planner app is the simplest way to stop feeling overwhelmed and start having a specific, step-by-step plan for paying off your loans.

0 kommentar(er)

0 kommentar(er)